Residents

Tax Assessor FAQ

Personal Property Division

***** CHECK FOR UNPAID TAXES BEFORE YOU BUY!!!! ****

People frequently buy a business, boat or aircraft only to find out, after the sale, that there were years of unpaid taxes on a piece of property. Attorneys typically check for real estate taxes due, but personal property is often overlooked.

***** IMPORTANT INFO FOR BUSINESSES ****

House Bill 482 was ratified by voters in a statewide referendum on November 2, 2011 and became effective January 1, 2011 Business personal property INVENTORY REMAINS TAXABLE! (the exemption will be figured during the billing process.) Please do not omit inventory values from your tax return.

BILLING QUESTIONS

Our office DOES NOT HANDLE BILLING. You may contact the following offices to obtain answers to your billing questions or to verify taxes have been paid on property:

- Houston County Tax Commissioner: Warner Robins - (478) 542-2110, Perry - (478) 218-4940

- City of Warner Robins: (478) 929-1148

- City of Perry: (478) 988-2740

- City of Centerville: (478) 953-4734

REAL ESTATE PROPERTY INFO

For questions regarding real estate property (commercial, residential, industrial, agricultural, etc.), please contact the Real Estate Department of the Tax Assessors Office at [478] 218-4750, or visit the website at http://www.qpublic.net/ga/houston/

PROPERTY TAX FORMS

Tax returns are mailed each year in January. If you need an additional tax return, please select the type of return below:

INSTRUCTIONS ON COMPLETING YOUR RETURN

Please select the type of return you would like assistance completing:

SUBMISSION OF YOUR RETURN

Mail your return to:

Houston County Tax Assessors

Personal Property Dept.

201 Perry Pkwy

Perry, Ga. 31069

Click here for a printable completion checklist.

We cannot accept returns electronically. We do accept returns via fax if no more than 6 (six) pages; however, due to the nature of the forms they are difficult to fax. Additionally, we are not responsible for lost transmissions. Your fax confirmation will not serve as verification of submission. WE DO NOT RECOMMEND SUBMISSION VIA FAX.

POSTMARKS & TIMELY FILING

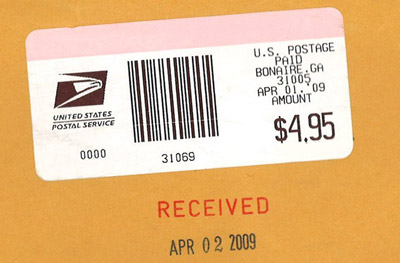

**Examples of postmarks to determine filing date. If you have any questions about what will be acceptable, please call us. ** (List is not all-inclusive.)

Envelopes with USPS postmark are considered received the date of mailing. Private meter stamps are considered received date of receipt.

ON TIME - USPS stamp on April 1:

NOT ON TIME (LATE) - private meter:

ON TIME - private meter that has been counter stamped by post office by April 1:

CLOSED BUSINESS INFORMATION

Our office must receive the proper documentation before the deadline in order to delete your account. Cancelling or non-renewal of your business license will not close out your account in our system.

Please print and fill out the Closed Business Form, attach any requested documents, and return it to our office to close out your business account.

SOLD BOAT / AIRCRAFT INFORMATION

If you sold your boat or aircraft, please submit a copy of your bill of sale.

The DNR now requires that sale of all marine vessels be recorded on a notarized bill of sale WITHIN 15 DAYS OF SALE. A copy of that document is available at:

FAA Bill of Sale:

MILITARY NON-RESIDENT INFORMATION

If you are located in Georgia by military order and do not claim Georgia as your state of residence, you may complete the Service Members Affidavit for Exemption to your boat/aircraft return. Submission of current LES is no longer accepted. The affidavit must be completed each year for exemption and does not renew automatically. This is not applicable to business returns.

CONFIDENTIAL DISCLAIMER

GA Code 48-5-314 mandates the Board of Tax Assessors to maintain in a confidential manner any return (report) obtained from or furnished by a taxpayer. Examples are accounting records, profit loss statements, income and expense statements, balance sheets and depreciation schedules, earnings statements, etc. Such information shall remain confidential and not open for public inspection.